Real Estate Expert Advice

- Offering Best Investment Options subject to Budget

- Choosing the best options for Residential, Commercial properties and Plots from multiple options

- Choosing the growing market and location best suited with investment budget

- Review of capital appreciation trends in the local market

- Statistical performance of Rental Yield on YoY in the local market

- Ease of Liquidation on invested property assets

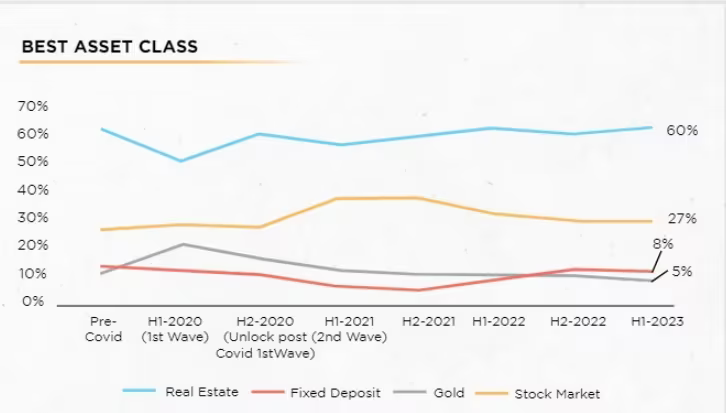

- Market Analysis of Different Asset Class indicating Builder’s strength in that particular asset class for better investment decision

Real Estate as best asset class

Service Description

Providing a tailored selection of investment options that align with the specified budget constraints of investors. This involves identifying and presenting the most suitable investment opportunities within the financial limits outlined by the investor.

Evaluating various available options across residential properties, commercial real estate, and land plots, and then recommending the most promising ones based on specific criteria such as location, potential for appreciation, rental yield, and market trends.

Identifying and suggesting investment opportunities in areas demonstrating growth potential and aligning them with the investor’s budget. This includes researching and pinpointing locations that exhibit promising economic development, infrastructure growth, and future prospects in line with the investment budget.

Analyzing historical data and trends to assess the past and potential future appreciation in property values within the local real estate market. This information assists investors in making informed decisions regarding their investment’s potential growth in value over time.

Providing statistical data on the Year-over-Year performance of rental yields in the local market. This information helps investors understand the income potential from rental properties and assess the stability and growth of rental incomes over time.

Assessing the ease and viability of converting or selling the invested property assets when needed. This includes evaluating factors such as market demand, resale potential, market liquidity, and ease of selling properties in the specific market.

Conducting a comprehensive analysis of various asset classes within the real estate market, highlighting the strengths and track record of builders or developers in specific segments. This insight aids investors in making well-informed decisions by aligning their investment preferences with builders specializing in those particular asset classes.

Real Estate Expert Advice

Jayata Sen Chaudhury

Ex Head of Global Commercial & Merchant Data Sciences American Express Bank India.

He has been a part of the BFSI sector for the last 25+ years. He holds a Doctorate degree in the field of Financial Economics and a Master’s in Quantity Economics.

He is a specialist in Analytics and Machine Learning and it’s application in solving business problems in areas of Marketing and Risk Management in Finance.

He owns several parents in the field of Analytics. He has won all the top awards in American Express his last institution.

Kaushik Banerjee

Civil Engineer & MBA

He has over 30+ years of experience in Infrastructure & Real Estate companies like L&T, Tata, Jacobs Engineering USA, and Maccaferri-Italy in very senior positions. He has vast experience in leading the Business Development, Project Execution, Legal and Contract, Claims & Risk Management for EPC & Service Management Contracts, Strategic Alliances, Technology Up-gradation, Capacity Building, Process implementation, and Real Estate Sales.

Arunesh SIngh

MBA- NRI Market & Client Specialist

He has over 15+ years of experience in promoting Real Estate market of India in overseas. He has strong connections and network with Indian diaspora in many countries. He is actively

helping and assisting Indian diaspora in buying, selling and managing their properties in India. He is managing many Investor Meet and organize such property show events across the Globe.